Established in 2018, Cosmo has become a leader in solar panel installation and renewable energy solutions. Recognized as one of the top solar companies in the U.S., we proudly serve both residential and commercial clients across the country.

Our commitment to sustainable energy is evident in our over 700 successful solar installations across eight states: Pennsylvania, Maryland, Texas, North Carolina, New Jersey, Georgia, Virginia, and West Virginia. Backed by a dedicated team of more than 174 employees who aim for excellence, we have established ourselves as the best solar company and a trusted provider of high-quality solar services.

Cut down your monthly electricity bill and enjoy 24/7 access to power.

Switching to solar power is a smart choice that pays for itself, offering years of low energy costs and clean energy. Here’s why thousands of homeowners are switching to solar:

Save an average of $1,800 yearly by installing solar panels and earn extra by selling unused energy back to your local utility.

Stay powered during unexpected outages with solar battery backup and storage solutions.

Reduce your carbon footprint, fight climate change, and inspire others by leading the way with renewable energy.

Solar-powered homes sell for a higher price, a smart investment as energy costs rise.

Take advantage of tax credits like the Solar Investment Tax Credit, reducing installation costs by up to 22%.

Built to endure sun, snow, and rain, solar panels also extend your roof’s lifespan and help keep your home cooler in summer.

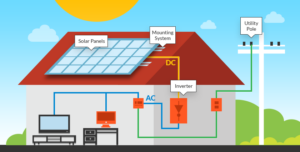

As the best solar company, we provide a free inspection and on-site engineering assessment before signing a contract for residential solar panels. Our team visits your property to deliver an accurate quote, prioritizing transparency throughout the process.

We specialize in commercial solar installation, enabling businesses to take control of their energy production and management with the help of skilled solar installers. Our solutions empower organizations to enhance their energy efficiency and effectively lower costs.

After the installation is complete, your solar company near me will cover your electric bill and financing payments for 10 weeks.

We offer free consultations for your solar project to discuss everything you need. This includes materials, installation, permits, rebates, and incentives, ensuring you understand every step of the process. To get started, just fill out the form to schedule a meeting with our experienced solar installers at your convenience.

Reach out to us anytime—whether it’s through our contact form or by visiting us directly on the map!

We’re licensed contractors with local offices in TX, VA, WV, MD, PA, NC, GA, and WA. With a team of 174 dedicated employees, we focus on making solar energy simple and accessible, helping you power your home with clean, renewable energy.

Yes, you will probably, even though you get an electric-powered invoice, but its miles will be lower. If your solar system generates greater electricity than you operate, you can even receive credit from your utility enterprise, lowering your bill.

Solar panels need very little preservation, usually costing around $150 to $300 yearly for cleaning and device inspections. This allows them to take walks effectively and extends their lifespan.

Yes, sun energy continues to be powerful during wintry weather. While shorter days and much less daylight can reduce power production, solar panels continue to generate power, and cooler temperatures can enhance panel efficiency. Any extra strength produced during sunny days may also be stored or credited through net metering to cover cloudy periods.

The cost of installing solar panels varies by home since every property has unique energy needs and uses electricity differently. Homes that consume more electricity than average may require additional panels to meet their energy demands.

The overall cost of residential solar power depends on factors like the size of your roof, the type and number of panels needed, and the design of your system. Most of the expense comes from upfront material and installation costs.

Residential solar panels can significantly lower your carbon footprint, offsetting around 100,000 pounds of carbon dioxide over 20 years. This is equivalent to the emissions from driving a car 100,000 miles!

Paying for a solar system can feel overwhelming, but both local and federal tax incentives can make it more affordable. Currently, the Federal Solar Tax Credit lets you save 26% on the total cost of your solar project.

We envision a world powered by green energy that empowers every aspect of life, advancing towards environmental harmony and economic growth. We are committed to creating a brighter tomorrow by being part of the renewable energy revolution.

info@cosmosolaris.com

205 W. Main Street, Abingdon VA 24210, United States

(757) 644-3466

We’re available 24/7

© 2024 All Rights Reserved – Cosmo Solaris| Designed & Developed by Nextsol